Customer Churn Explained + Reducing SaaS Churn Rates

Growing a business isn’t just about acquiring new customers—it’s about maximizing the value of your existing ones. While many focus on reducing churn, the real game-changer is achieving net negative churn. In other words, your expansion revenue (upsells, cross-sells, and upgrades) should outpace lost revenue from churned customers.

This is the key to sustainable SaaS growth. In fact, it's key to business growth in all other business models as well, but I'll talk about SaaS, as that's where most of my experience is in.

When your monthly churn is +3%, your revenue will go from $0 to $140.000 in three years.

But if your churn is -3%, your revenue will be $450.000 after three years.

In other words: Decreasing your monthly churn by 6 % will lead to a staggering 221.429% increase in revenue.

Also bear in mind the old truth that it is five times more expensive to attract new customers than it is to retain an existing one.

Read more to find out everything you need to know about churn rates and how understanding it better will directly lead to:

- Fewer customers lost

- Less revenue lost

- More recurring business

- Less work for the sales team

- Lower customer acquisition costs

- Better customer lifetime value

Customer Churn in General

Customer churn = customer attrition = churn rate = customer turnover = customer defection = customer decay

Call it what you will. In laymen's terms, it means that you lose customers (or subscribers if you are a SaaS company)

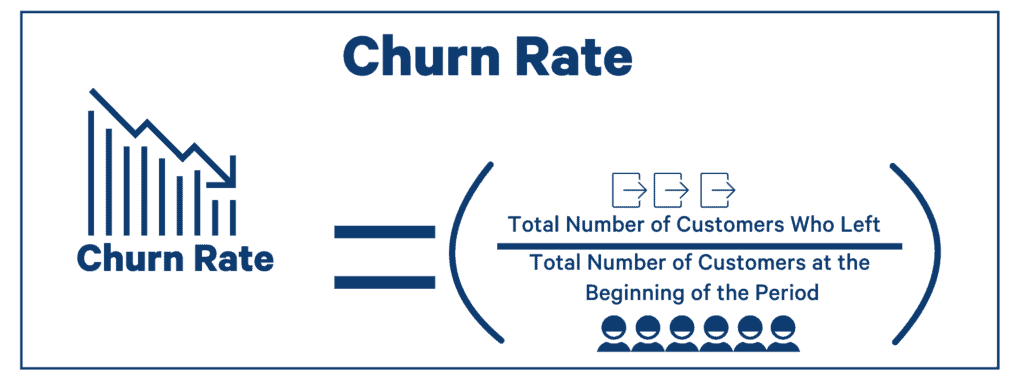

Churn is the percentage of customers that stopped using your services or products within a certain period. The period can be anything from daily, weekly, monthly, quarterly to annually, but most businesses calculate churn monthly, quarterly and annually.)

Here's a simple way to calculate your monthly churn.

- Take the total number of customers who left you that month

- Divide that with the total number of customers at the beginning of the month

- Multiply by 100 (to get the %)

- Voilá! You have your monthly churn rate.

If you need the weekly rate, just use the weekly numbers. Easy.

Note that churn rates vary greatly by industry. You should know your market, customer segments and customer journey to be able to reduce churn effectively.

What is Revenue Churn?

By calculating customer churn rate, you'll find out how well you are retaining customers. Revenue churn gives you an idea of how well you are retaining your revenue over a certain time period.

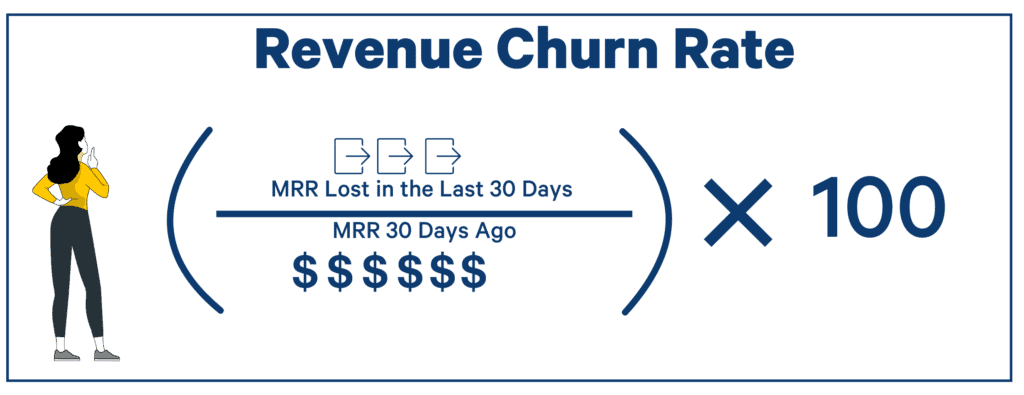

Revenue churn can be used to analyze how churn is affecting your total revenue.

Most commonly, revenue means Monthly Recurring Revenue (MRR) which translates to the revenue your business is expected to receive over 30 days.

What Is the Benefit of Measuring Both Customer Churn and Revenue Churn?

By using both of these metrics, you'll be more likely to identify the number of customers lost, the lost revenue and the overall effect that'll have for your own business.

There are two important abbreviations to understand that play a role in the customer churn game.

- CAC = Customer Acquisition Cost = How much money it takes to get ONE new customer

- LTV = Lifetime Value = How much revenue does a single customer bring in during the time they use your products/services.

Wait. Why are these relevant? We are talking about churn rates and how churn can be reduced.

Churn rates and keeping existing customers are important, because:

- The lifetime value of each existing customer should always be at least three times more than the original customer acquisition cost was.

- The payback time for each customer should be less than 12 months

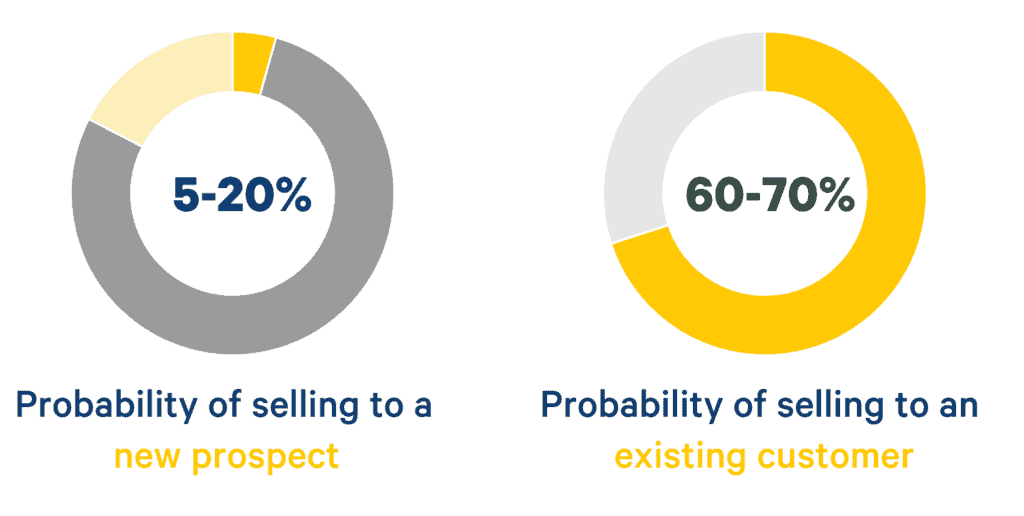

- It's more 60-70% more likely that you sell something to an existing customer than to a new prospect

In conclusion: Every customer lost means you are losing revenue in the long run. Big time.

Let's dive into identifying churn to be able to do customer churn prediction.

How to Identify Churn in Your Business?

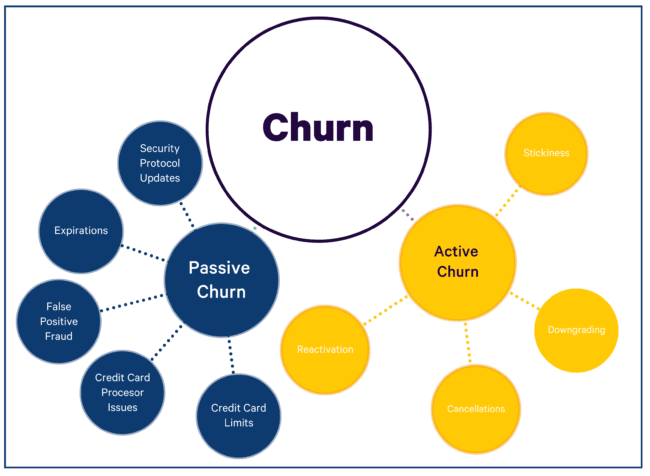

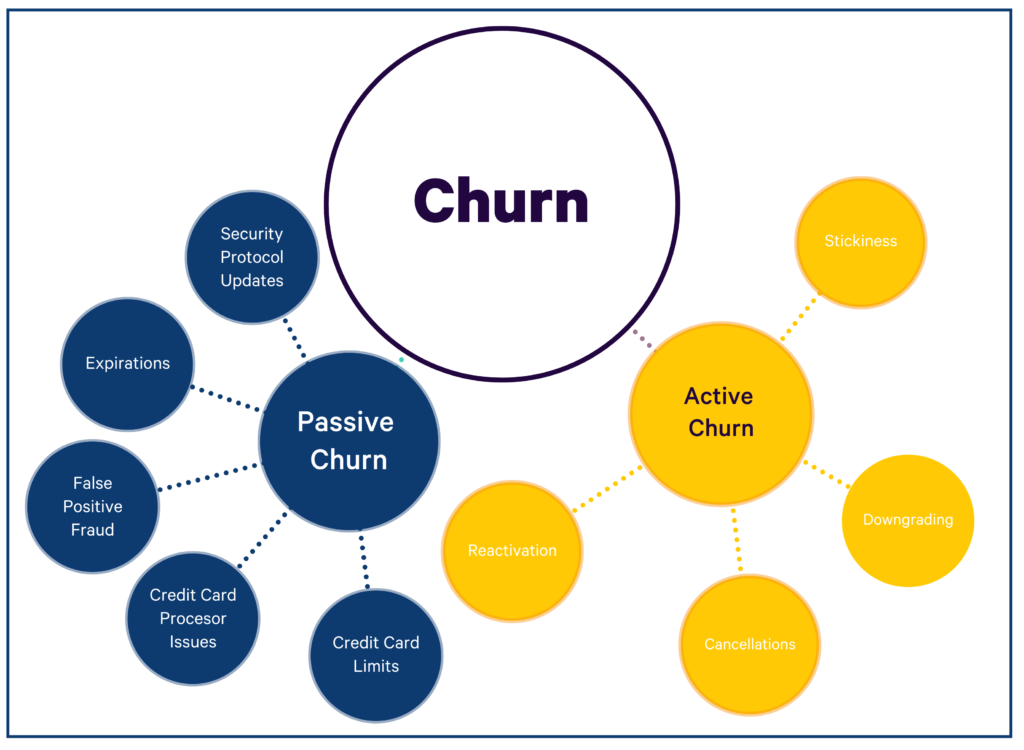

Generally speaking, churn can be divided into active and passive churn.

You need to identify which are the key points in your customer lifetime cycle where customers stop buying from you. Only after that you can start to reduce customer churn.

- Active Churn means your customers make a conscious decision to leave you. They include:

- Downgrading

- Is an existing customer downgrading their current subscription?

- Cancellations

- Do you have dissatisfied customers who are cancelling their order altogether?

- Stickiness

- How often do your customer return to your product? Or use it more frequently?

- Reactivation

- Means the process of convincing your past customers to buy from you again. Putting it simples, someone churned, but you convince them to immediately come back.

- Downgrading

- Passive Churn is harder to control, but here are some touch points to consider.

- Expirations

- Their subscription period has come to its end. Get to the bottom of why customer churn happens at this stage to lower that churn rate fast.

- Credit Card Processor Issues

- If your customers' credit card has expired or is shortly going to, that'll automatically cancel their subscription.

- False Positive Fraud

- If your customers are being flagged as frauds, and unable to use the service at all, it's guaranteed to make them never come back. Try using multi-factor identification and the latest technologies available to prevent customer attrition. As explained in this complete guide to chargeback protection, you also need to have systems in place to identify falsely filed claims in this context as well, both to keep customers satisfied and protect your business from being unfairly exploited.

- Security Protocol Updates

- Credit Card Limits

- Expirations

A Simple Guide to Analyze Churn

Analyzing churn sounds like a piece of cake, right? You simply calculate customer churn rate, look at the number you got, compare to others in the industry and decide to do better to lower the churn rate in the future.

Wrong.

Analyzing customer churn includes figuring out:

- What your customer churn rate is

- WHY those customers churned

- When exactly did they churn

- How to fix the customer journey to lower you average churn rate

5-Step List for Analyzing Customer Churn

- Define timeframe for analysis

- Calculate customer churn & revenue churn

- Ask customers why they left

- Identify touch point where customer churned

- Make churn prevention priority for all departments

Let's take a scenario, where a CEO notices that their total number of customers has gone from 5.000 to 4.800 in the past three months.

Before the CEO starts calling and blaming sales, customer success and marketing directors, they need to investigate what is going on by analyzing which customers have left and why.

1. Decide the time frame you want to analyze the data

How sudden has the drop been? Not sure? More is better! The more you have data to analyze, the better.

2. Calculate customer churn rate and revenue churn

Compare the annual to quarterly and even to monthly levels. Also compare to your previous data from that period to see changes. For example, monthly churn in March 2021 to March 2020 and March 2019, but also to February 2021 and April 2021. The more you compare the numbers, the more patterns you'll start to see in customer churn.

3. Find out WHY your customers churn

It's not enough to know how many customers churned. You need to figure out why they that happened. Automating feedback collection in key stages of your customer journey is the best way to do this. Including the stage where they left you.

The worst kind of customer attrition is when they leave without you even noticing and getting the chance to ask why. (I hate ghosting in personal and business life...)

4. Look at which part of the customer journey customers churn

Collecting customer satisfaction data in different part of your customer path will also help you identify where exactly your churn rate is the highest and where the lowest.

If there are many black spots where customer churn happens, but you aren't sure why, make sure to start asking for feedback before, after and maybe even during that part of the journey.

5. Figure out a plan to decrease churn rate in each department

Once the CEO has analyzed all this data, they should go over the results with the people responsible for sales, marketing and growth. As churn rate is easy to measure, it is also easy to track if the staff has succeeded in increasing customer retention in the future or not.

Make it a common goal in your company to keep the customers happy to prevent churn.

Not sure how to start reducing it? The next list is for you.

9+1 Ways for Reducing Churn in 2025

When you've understood the importance of keeping your existing customer base as happy as possible and to lower customer churn rates in the long run, you're on the right path in growing your business.

Here are nine actionable ways for preventing customer churn.

1. Measure Churn and Do Customer Churn Analysis

Measuring churn will give you the data you need to make sure you are doing well and growing as a business. Simply looking at new customers in doesn't mean a thing, if your customer churn rates are skyrocketing.

By regularly looking at the customer churn data you'll be able to spot trends and to become better at predicting customer churn. This the key to be able to retain customers before they leave. It's so much easier to retain customers than to convince churned customers to come back once they've decided to leave.

2. Focus on Providing Exceptional Customer Service

In most cases, it's enough if you just give good customer service to your current customers. Do aim to go above and beyond, as your best customers bring you an astounding 14 times the revenue than what a somewhat dissatisfied customer.

3.Retain Existing Customers > Getting More Customers

Focusing on customer loyalty is KEY. And don't forget brand loyalty. How are you making sure you are creating added value to your customers AND that they think so too? Here’s a quick read on increasing customer loyalty.

Returning customers are 60-70% more likely to buy from you than new customers. Don't forget to think about your CAC as well.

4.Increase Customer Lifetime Value

Your goal is to create recurring value to your customers.

How well are you succeeding in offering this

- for your existing customer base

- for new customers?

Here's hard data on you should focus more on creating more value for existing customers:

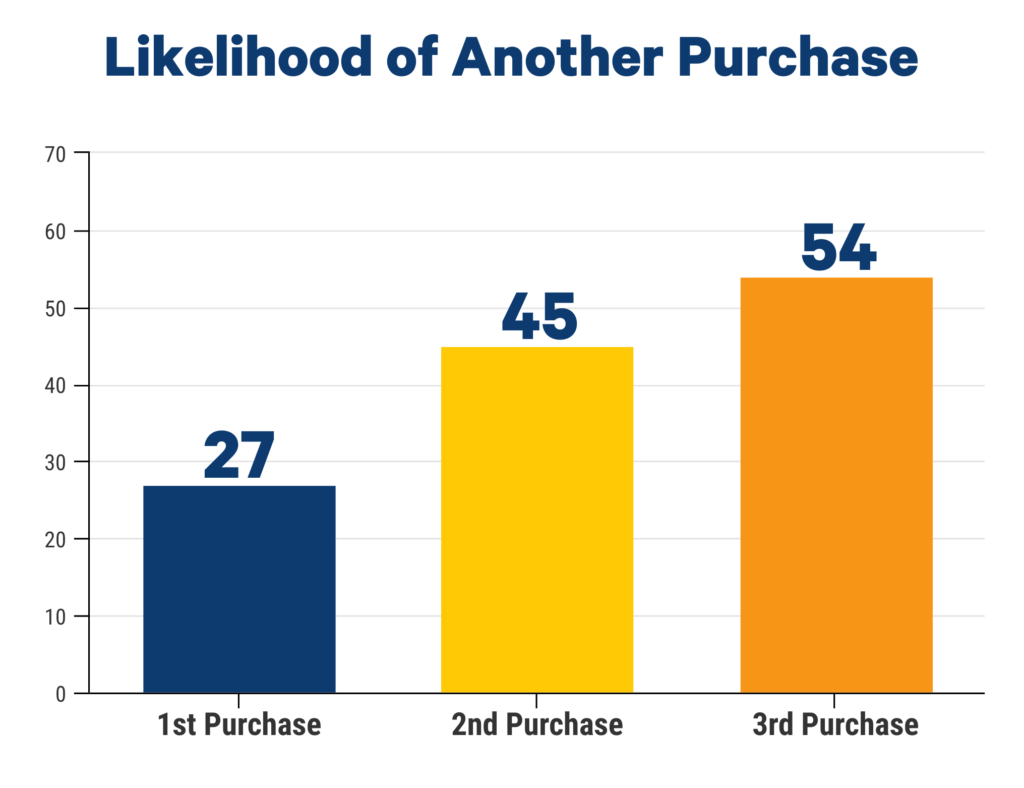

- After a customer has purchased something from you once, there's a 27% chance that they'll buy from you again.

- After the second purchase they are 45% likely to come back

- The odds keep on rising, as if they come back again, the odds for another purchase climb up to 54%

5. Constantly Measure Customer Satisfaction

The major benefit of constantly measuring your customer satisfaction is that you are aware of what your customer think about you. Measuring customer satisfaction will help you identify which actions you should take today to stop losing customers.

If you aren't already measuring customer satisfaction levels on a daily or weekly basis, start now. Get started in less than five minutes with our free trial.

Did you know that the customers how gave you a 7 or 8 out of 10 (Net Promoter score) are the most at risk customers to leave you?

If you're not familiar with NPS and NPS surveys, read more about NPS promoters, NPS passives, and NPS detractors.

Figure out who these 7s and 8s are, and you can make them happier before they churn.

In this process, embracing constructive criticism and acting upon it is more valuable than ever.

To help you started, here are a couple of resources:

- Create A Customer Satisfaction Survey: 11 Things to Consider

- 100+ Customer Satisfaction Survey Questions to Copy

6. Identify Customers That Need Your Help

If your existing customers are feeling that they aren't getting their money's worth from you, they'll become a number in your "churned customers" statistics. To prevent this from happening, ask for customer feedback with feedback forms.

You need to know what's broken in order to be able to fix it. This is not just about trying to reduce customer churn, but more about recognizing on identifying the key hurdles within your customer base during their customer lifecycle.

Another way to identify which customers you should focus on helping is by developing a customer health score. A lot of brands, especially SaaS companies, use a customer success platform to track things like product usage, support tickets, engagement with emails, NPS & CSAT scores, in one place. With all of that data together, you can create a formula to represent how 'healthy' or 'at-risk' each of your customers are. For example, if product usage or NPS drops, it detracts from the score. If it falls below a certain threshold, your team can proactively reach out to offer help.

7. Apologize for Poor Service

We all make mistakes daily. That's guaranteed. Customers churn when they feel like their opinion or experience isn't important. One simple and effective way to reduce customer churn is to apologize for any mistakes made.

5 step Foolproof Formula for Apologizing

- Listen to what your customer has to say. Don't interrupt!

- Count to five (or to 500) before answering.

- Don't start explaining yourself, but simply apologize

- Ask how you could make the situation better

- Do your best to make their wishes come true

If you succeed in making their wishes a reality, you are actively reducing customer churn rate.

However, sometimes customers churn even though we've tried our hardest. That's okay. But by using this formula to handle tricky situations, you're significantly increasing the chances of your customers sticking around.

8. Value Customer Loyalty

Focus more of your marketing efforts on your existing customers. As you've already created a loyal user base, why not make them more engaged?

Points to consider:

- Are they aware of your new products and services?

- Tell them how they can benefit even more from using your services

- Write customer cases with data that can help others to succeed better

- Do you have a customer loyalty program?

In other words: Focus heavily on rewarding customer loyalty.

Real-life Example: Oura

I bought an Oura ring in January 2019 and I've used it daily to this day to track my sleep, activity and general readiness scores.

Oura then announced their 3rd generation Oura-ring in 2021 and sent all the 1st and 2nd generation ring owners a personalized code to get 50€ off their purchase. In addition, they offered a lifetime membership to their app if you place your order using the discount code during the next 14 days.

To people unfamiliar with Oura, the use of their app has been free until the launch of this 3rd generation ring. For new users, it'll cost monthly 5€ = 60€ annually.

Needless to say, I placed my order for a new ring without much hesitation. Why?

I felt that they are interested in keeping me as a customer when they offered this exclusive deal to me instead of new customers.

If they would've announced "Here's our great new ring! Buy it here! Oh, and btw, you'll now have to start paying us an additional 60€ every year to get to see the data the ring saves" I would've thrown my ring away immediately and never become one of their customers again.

Instead, they engineered a genius plan to increase customer retention, to get pre-orders and to minimize customers lost.

Bravo Oura, bravo.

How could you do something similar, when you launch a new product or service to reduce customer churn?

9. Treat Your Customers as Actual Human Beings

No matter if you're a SaaS company, do B2B or B2C, every single one of your customers is a real human being. And they want to be treated as such.

Always treat your customers how you'd like to be treated. Furthermore, talk to them like they are humans. Even though you might feel that you serve companies, not individuals, remember that there is always actual individuals who use your products and services.

And the most obvious of them all as a bonus.

Constantly ask for customer feedback, and DEVELOP YOUR PRODUCT OR SERVICE ACCORDINGLY

No-one will use a product that isn't creating them value (anymore). This is also one key elements of product led growth. When was the last time you stopped using something as it wasn't quite your cup of tea anymore or just stopped creating any value for you?

Okay, moving on to a more in-depth topic: Net negative churn.

What is Net Negative Churn?

Before diving into why this metric is crucial, let’s define some key terms:

- MRR (Monthly Recurring Revenue): The predictable revenue your SaaS business generates every month.

- Churn: The percentage of revenue lost from customers who downgrade or cancel their subscriptions.

- NRR (Net Revenue Retention): The percentage of revenue retained after accounting for churn, expansion (upsells/cross-sells), and contractions (downgrades). If NRR is over 100%, you have net negative churn, meaning your business is growing even without new customers.

Why Net Negative Churn is the Growth Engine of SaaS

If your SaaS business relies solely on acquiring new customers, you’ll face an uphill battle. Here’s why net negative churn is the real growth driver:

1. It’s Easier to Sell to Existing Customers

- Selling to existing users is significantly easier (and cheaper) than acquiring new ones. Customers already trust your product, so expanding their usage is a natural next step.

- Instead of focusing only on new customer acquisition, shift your strategy to encourage upgrades, additional seats, or complementary services.

- Studies show that acquiring a new customer can be 5 to 25 times more expensive than retaining an existing one. SaaS companies that optimize for expansion revenue see higher profit margins and long-term success.

- Customer Feedback & NPS: Identifying your happiest customers through Net Promoter Score (NPS) surveys allows you to focus upsell efforts on users who are most satisfied with your service. Happy customers are far more likely to expand their usage or purchase additional products.

2. Churn is Inevitable—But You Can Outgrow It

- No matter how great your product is, some churn will always exist. Customers might go out of business, pivot, or simply no longer need your solution.

- If you depend solely on minimizing churn, you’re playing defense. A stronger strategy is to make sure your expansion revenue is consistently outpacing lost revenue.

- Reducing churn should still be a priority, but rather than just fighting cancellations, invest in customer education, personalized onboarding, and proactive customer success.

- Leveraging Feedback to Reduce Churn: Collecting feedback at different customer touchpoints—such as onboarding, product usage milestones, and support interactions—helps detect dissatisfaction early. This allows your team to address pain points before customers decide to leave.

3. Different Customer Segments Have Different Churn Rates

- Not all customers are created equal. Your core ICP (Ideal Customer Profile) is likely to have much better retention than lower-fit customers.

- Analyze your NRR by segment—enterprise customers might have an NRR of 120%+, while SMBs could be closer to 90%. Understanding these differences helps you focus on the most profitable customer groups.

- The key to optimizing retention is understanding why different segments churn. Are certain industries more likely to leave? Are smaller teams more price-sensitive? Use data to guide strategic decisions.

- Using Review Data for Segmentation: Customers who leave positive reviews and score highly on NPS surveys can be nurtured for long-term loyalty and potential upselling opportunities, while those who provide negative feedback require additional support to prevent churn.

4. Higher NRR Means Compounding Growth

- If your NRR is over 100%, your revenue grows even without new customers. The higher the percentage, the faster the growth.

- Companies with an NRR above 120% (like many successful SaaS giants) scale much faster because every cohort of customers becomes more valuable over time.

- Investors and stakeholders closely monitor NRR as an indicator of long-term sustainability. Companies with strong NRR tend to attract higher valuations and funding opportunities.

- Turning Feedback into Expansion Revenue: Actively reviewing customer feedback helps identify feature requests and usage trends that can guide product enhancements, making upsells and cross-sells more natural and effective.

How to Improve Net Negative Churn

To achieve net negative churn, focus on these strategies:

1. Drive Expansion Revenue

- Upselling: Encourage customers to move to a higher-tier plan by offering more value.

- Cross-selling: Introduce complementary products or add-ons that enhance their experience.

- Usage-based Pricing: If applicable, structure pricing so that customers pay more as they grow.

- Bundling Services: Offering packaged solutions with multiple features can increase adoption and reduce cancellations.

- Targeting Promoters for Upsells: Customers who rate your service highly in NPS surveys are prime candidates for upsell opportunities.

2. Reduce Avoidable Churn

- Proactive Customer Success: Engage customers before they consider leaving.

- Monitor NPS and Feedback: Track Net Promoter Score (NPS) and act on feedback to improve retention.

- Optimize Onboarding: Many cancellations happen in the first few months. Ensure new users see value quickly.

- Loyalty and Rewards: Reward long-term customers with exclusive benefits, ensuring they stay engaged and satisfied.

3. Enrich Your Data to Optimize Retention and Upsells

- Identify High-Retention Segments: Focus acquisition efforts on customers who are most likely to expand their accounts.

- Prevent Churn in At-Risk Segments: Offer incentives or personal outreach to customers in segments with higher churn rates.

- Use Feedback to Enhance Customer Profiles: Enrich customer data with qualitative insights from feedback to personalize engagement and support.

Conclusion: Make Net Negative Churn Your Growth Priority

Let me underline this one more time: Net negative churn rate is the only way to grow your SaaS.

For SaaS businesses, sustainable growth comes from ensuring that existing customers increase their spending over time. If you rely only on new customer acquisition, you’re running on a treadmill.

Instead, focus on achieving net negative churn by boosting expansion revenue, enriching customer data, leveraging feedback effectively, and understanding how retention varies across customer segments.