Customer Lifetime Value – How to Make More Money with Less Customers

Are you aware how much of your total revenue comes from repeat business and what your retention rate is? Learn to identify your high value customers and to focus on them to grow your average revenue in the long run.

Customer Lifetime Value Defined

A customer lifetime value is a definition of how much net profit the customer brings to the business during the business relationship.

There are many abbreviations of the term, but they all basically mean the same thing. Here's a table to clarify:

| Abbreviation | Term |

| CLV | Customer lifetime value |

| CLVT | Customer lifetime value |

| LTV | Lifetime value |

| LCV | Lifetime customer value |

Even though the term is quite often used, not many companies actually know, what their customer lifetime value is.

Not to mention, what are the characteristics of their most valuable customers, how their buying journey has gone, or how the lifetime value is distributed over time.

Benefits of Knowing Your CLV

The lifetime value is an interesting concept for companies for many reasons. It can be used to

- Create a predictive model for long term growth

- Focus customer success' efforts to high CLV customers

- Reduce churn rate in the long run

- It's a key metric for investors

- Lower unnecessary marketing expenses by focusing on your ideal target group

- Find product market fit faster

- Identify cross selling opportunities

Most importantly, you'll be able to let data guide your marketing and sales decisions instead of a gut feeling. Tracking customer lifetime value makes sense no matter what your business type is.

At the end of the day, it helps you recognize which customers cost you more than their average value is. Furthermore, when you focus on improving the customer experience of the high customer value customers, you're basically investing effort in your best customers and keeping them.

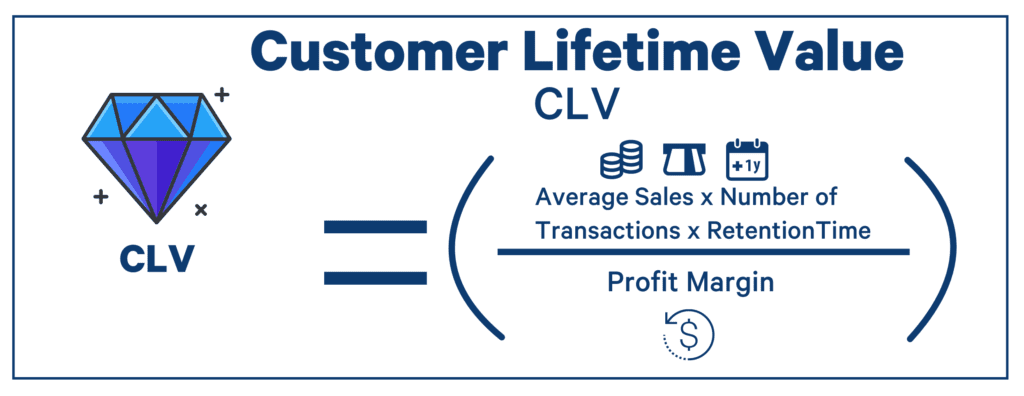

Customer Lifetime Value Formula

You can easily calculate CLV by using this formula:

Take the average sales, multiply by number or transactions and retention time. Then divide this by profit margin.

If you have many customer segments, it might be beneficial to calculate the average CLV for each of them.

However, the subject of this blog isn't to determine the lifetime value of your customers or to learn to analyze the best customer groups or marketing channels based on it, but to maximize the lifetime value of an individual customer.

Let's get to it.

3 Tips for Customer Lifetime Evaluation

1. Move from Project Business to Recurring Revenue Business

In order to maximize the lifetime value, it is usually worthwhile to try to create a continuous customer relationship instead of a single project.

This might mean that you offer a partnership instead of a one-off project. Try to imitate the principles of what subscription businesses are doing.

Offer maintenance packages and add-ons, promote your new products to old users, offer discount codes for loyal customers, and so on. There are a million ways to do this!

2. Cross-sell and Upsell to Happy Customers

It is very common for online shops to use re-activation campaigns with their email marketing, that are meant to convince the customers to buy again, before they end up purchasing from a competing business.

In sales organizations, the same thing works many times so that the seller is assigned to contact the customer again at a specific time in the CRM.

Building this type of loops are essential for maximizing the lifetime value of a customer. Of course, it is worth the effort to obtain new customers as well, but the ones already existing shouldn't be forgotten.

3. Identify High Potential Customers, and Treat Them Well

Increasing the lifetime value is also about focusing. A two-person company obviously has a smaller budget, than a 472 million listed company does.

If your ideal customers are listed companies with more than 200 million exchanges, you should make a clear plan for increasing your customer base with these types of clients.

Make a step by step -plan that clearly shows which issues are focused on at which point, and how to get the customer to buy as many products from your company as possible.

Typically, this means that first you will sell services that cause an immediate positive surprise – aka you get fast wins.

After this, the goal is to get the customer to buy all the possible products suitable for them from the company's portfolio.

Maximizing the Lifetime Value of a Customer

It is not rocket science, but it can be science.

Make decisions based on data, and make determined efforts for growing the lifetime value of your customers. So in addition to obtaining new customers, focus on getting more out of the customer your company already has.

At the end of the day it is all about if the customer feels like you are offering a lot of added value. If the customer feels like your services are bringing a lot of value to their business, they will most likely buy more.

And on the contrary, if the client feels like your services are not bringing them any added value, they most likely won't buy it again.

So in the end, maximizing the customer lifetime value is a lot about focusing: what is the best target audience for my product or service?

You can try to figure out the target audience by using quantitative or qualitative data.

Usually you can get further by using some form of data. If there is not yet enough quantitative data to be found, the only reasonable option is to perform a qualitative customer research.

With a qualitative customer survey you can figure out the highs and lows, and what are the common factors all your best customers share with each other.

What are the things they value the most, and what is it that made them purchase in the first place?