Collect, analyze and showcase feedback

Turn customer insights into a growth engine with a 3-in-1 customer feedback tool. Improve customer experience by learning from customer feedback, and attract more customers with authentic customer reviews. All this automated with one tool.

Trusted by 1800+ companies all over the world

Up to 4 times more responses

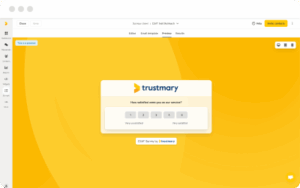

Get feedback and reviews with 3-in-1 surveys

Measure customer satisfaction, get open feedback, and collect reviews at the same time with one branded survey.

Improve your business using feedback

Analyze feedback and reviews and turn them into insights

Turn customer feedback and online reviews into actionable insights with AI-powered analysis and reporting tools.

Build trust with reviews

Add reviews to website, search engines and more

Share reviews in all channels. Add reviews to website, share them on social media, and build reputation in search engines and AI tools.

Not just another feedback tool

Simplify your feedback collection and social proof efforts with one tool. Turn feedback into actionable insights and use it effectively – not just internally,

but also as a marketing asset.

On a mission to restore trust between businesses and customers

The world is full of distrust, but we want to change that. Customers deserve real, unbiased opinions about businesses to make confident decisions. We inspire businesses to grow by embracing authentic customer feedback and showcasing it transparently.

Hear it from our customers

Trust builds business in all industries

Trust is essential in all industries. We help companies to embrace the power of social proof in the digital era.

Customer insights help the whole organization

Make customer experience a priority across business functions

From feedback to revenue – automatically

Automatic workflows for feedback and reviews lead to real results.

2-4 times more survey responses

30 % conversion rate from feedback to review

20 % more leads or sales from website

Automate and integrate

Trustmary seamlessly integrates with your other daily tools, and creates automation flows that make your work easier.

Case studies show real life results

Businesses across the globe and different industries have achieved great results with Trustmary.

Case Kattotutka: Over 60% Increase in Contact Requests

Hohdepinnoitus: Customer Insight at the Heart of Growth

Oivatek: 127 Reviews in Six Months, 75% Survey Completion Rate

Balkonser: Turning NPS Data to Better Decisions and Growth

Jalonom: The Power of Feedback Surprised The Family Business

Potters Resorts Collects 37% More Reviews with Trustmary

Vainu: Better Feedback Leads to More Sales

Perintäritari: Customer Feedback Is the Best Marketing

Balanced Growth Boutique: Improving Google Profile and Website with Reviews

Case Wannado: Feedback Tripled with Trustmary and CRM

Sellai Oy: Improving the Product and Acquiring More Customers with Reviews

Potters Resorts Collects 37% More Reviews with Trustmary

Vanajanlinna: €40,000 Worth of Contact Requests from Website in 2 Months

From people to people

We are here to help!

Trustmary is made in the world’s happiest country, Finland, and used worldwide. We trust in human touch and our praised support team is there for you. Not just a software but dedicated support for your success.